Educating Business Owners about Tax Deductions.

When is the RIGHT TIME?

When is the "right time" to retire? In my opinion, there is no "right time". It is when the time is right for you! With the PE money coming into the accounting space, we are seeing mergers, sales and everything in between. Firm owners are feeling the pressure. Shall I...

How many lunches is TOO many?

I love to browse social media between meetings. Here is what I see...a lot of professionals seem to spend a lot of time networking, breakfast lunch and dinner. I do wonder .................what is the ROI on the time and money spent? Or is it just for the optics that...

Glass half full?

Did you see this article? https://www.linkedin.com/news/story/pwc-to-lay-off-1800-employees-6148540/ So either you see the glass as half full and respond with - Wow, this means 1800 well educated and trained professionals will be looking for work - fantastic, I bet...

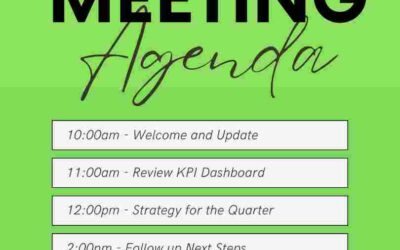

No Agenda = No Meeting

Yesterday, I reconnected with a client who expressed to me how much she always respected and enjoyed our meetings because I always sent an Agenda 24 hours before the meeting so that she could be prepared for what we would discuss AND I always showed up to the meetings...

Are you the business owner or the laborer in your firm?

You have a choice - who do you want to be? You can be the business owner or you can work in your business, be the laborer. There is no right or wrong answer here. You need to be you. Some professionals love being a business owner - setting the goals and the vision,...

Buy NOW Pay LATER

Is this how you run your professional services firm? May I suggest a new strategy - one adopted by attorneys a long time ago - deposit, retainers and payment before service, rather than after. We are not in the business of banking or debt collecting. Lets stop being...

Business Productivity – deep dive!

Saying NO can be a complete sentence

Let me give you permission today and forever more to say no. No, thank you. That is a complete sentence. There is no need to explain. If a client or a team member is not a good fit for your firm, it is ok to say no. If a vendor is offering a service you dont really...

The ONE big thing

I am often asked what ONE THING firm owners can do immediately to make a change in their firm to feel results - my answer-> hand over your email box to someone else to manage. This is the ONE THING that forever changed me and the trajectory of my firm. Was it...

Faced with a difficult decision?

As a firm owner, who do you turn to as your sounding board when faced with a difficult decision? This may be one of the few benefits of having a partner in your business. Family, spouse, colleagues are not necessarily the best choice here. They have the best...