Educating Business Owners about Tax Deductions.

Is your bookkeeping ready for year end tax planning?

It is THAT time of the year again. We are scheduling our year end tax planning meetings. Exciting, frightening and yes necessary! If you don't have your bookkeeping for 2022 updated, NOW is the time. In order for us to do effective income tax planning for you, we...

“Ignite Success” with Vera Jones From Vera’s VoiceWorks, LLC

On "Ignite Success," Wendy Barlin welcomes outstanding leaders to this uplifting and interesting show, filled with practical advice and tips for business professionals. This week, Wendy spoke with Vera Jones From Vera's VoiceWorks, LLC. To learn more,...

A business or a hobby?

I often get calls and emails from clients who want to run their hobby into a tax loss by deducting all sorts of related expenses. Hmnn, well sometimes this works and sometimes it doesnt. So let's dive into what the IRS considers a hobby versus a business. The great...

Special COVID 19 relief BUT file your 2019 and 2020 tax returns before September 30th

The IRS last week reminded individuals and businesses, affected by the COVID-19 pandemic, that they may qualify for late-filing penalty relief if they file their 2019 and 2020 returns by September 30, 2022. The relief, applies to the failure-to-file penalty. The...

Hiring A Players continues to be challenging for small business owners

Don't miss my interview with Jill Lutz. Hiring continues to be a challenge for small business owners who are competing with the big guys on salary and benefits. What can we do differently? Better?

“Ignite Success” with Connie Pheiff from Talent Concierge

On "Ignite Success," Wendy Barlin welcomes outstanding leaders to this uplifting and interesting show, filled with practical advice and tips for business professionals. This week, Wendy spoke with Connie Pheiff from Talent Concierge. To learn more, check...

“Ignite Success” with Jill Lutz from Let’s Build Talent

On "Ignite Success," Wendy Barlin welcomes outstanding leaders to this uplifting and interesting show, filled with practical advice and tips for business professionals. This week, Wendy spoke with Jill Lutz from Let's Build Talent. To learn more, check...

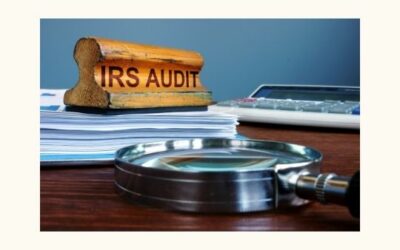

Who gets audited?

Have you ever wondered who the IRS targets for audit? It is often not who you would guess. One of the most common strategies the IRS uses to select taxpayers for audit is Computer Scoring. This is where tax returns are compared to statistical norms from the National...

The IRS Won’t Call You

Have you answered your phone and found an IRS agent on the other end? That is NOT an IRS agent. These are SCAM calls. The IRS will NOT call you. The IRS ALWAYS notifies you of any issues by mail. Sometimes the notice you receive in the mail will have the name and...

Credit card payments are not tax deductible

According to Wallet Hub, the median credit card debt is now $2,260. This is up from 2020 in the peak of COVID and is for consumer credit cards. So are we as business owners incurring credit card debt also? I always find it important to remind business owners that your...