At least once a day I get this question from my clients – should I lease or buy a car or truck? And sadly, the answer is always, that depends. I know I know, you want a solid yes or no answer but its complicated. The law is not complicated, each person’s own tax situation is different based on your goals and cash flow so how we apply the law to you is complicated. Got it!

If you are someone who always wants to drive a new car then leasing may be a better lifestyle choice, use of cash and tax deduction. If you are more cash conservative then you will most likely choose to buy a car and keep it for ten years or more which is the smart cashd ecision. Taxes come after cash. We make smart cash decisions and then see how we can use the tax law to your benefit. I do not recommend making smart taxes choices to the detriment of cash, cold hard green money.

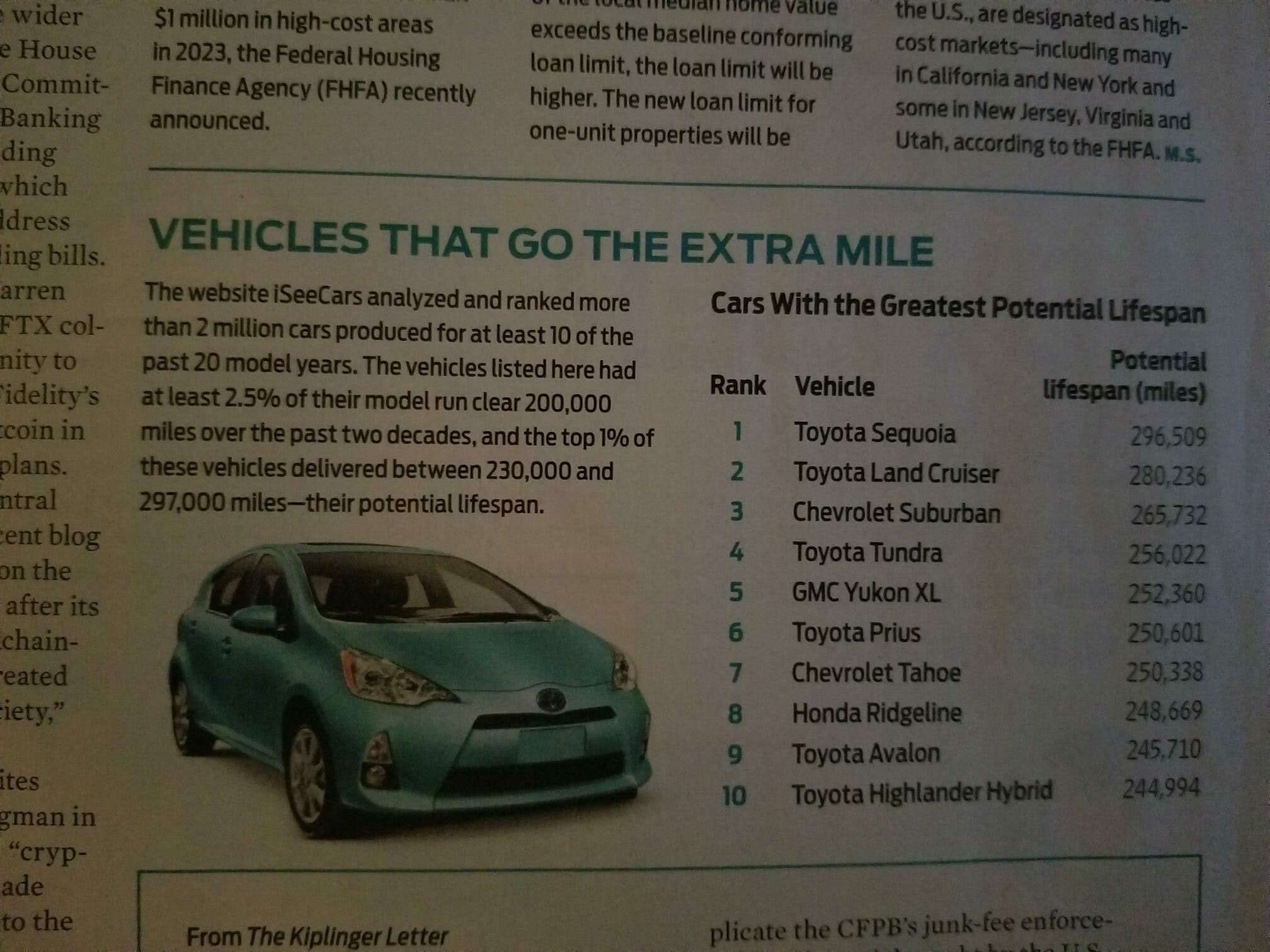

See the attached chart. Interesting right? Now what I would love to do is compare their out of pocket cash expenses for gas and repairs and their tax deductions to someone who leased over the same period.

Take a look and see how your auto expenses and buying choices compare to these vehicles.

I do love talking about this so please reach out to me any time to discuss your own situation.