Yes, we are all looking for ways to keep our A Players!

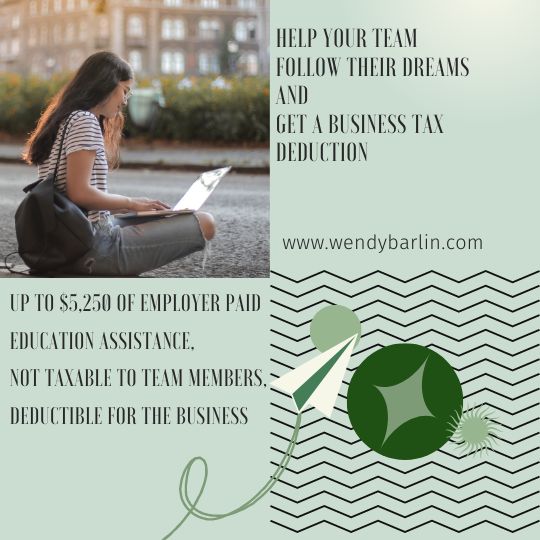

One of my favorite strategies is to offer up to $5,250 of education assistance to my team members. This is a nice tax deduction for my business and is not taxable to my team members. Feels like “free money” to my team!

Expenses you can pay for can include costs of books, equipment, fees. supplies and tuition.This education assistance also includes graduate level courses. Do be careful however as costs related to sports or hobbies will not be covered. Also costs of lodging, meals and transportation are not covered.

Another piece of the law under Education Assistance is team member student loans. As business owners, we can make student loan payments for our team members before December 2025.

Many business owners ask me what benefits they “should” offer their tem members. In my opinion, we should ask our team members what benefits are of value to them and then see if we are able to meet their needs or compromise somehow.

So, lets meet with our team members and ask them what they want. Are they interested in further education? Do they have student loans? This way we can offer benefits that team members actually want rather than benefits we as business owners think they need.

For more tax deductions, join me at our launch of THOMAS, a 3 hour online tax deductions workshop or for a more personal tax question, reach out to me.