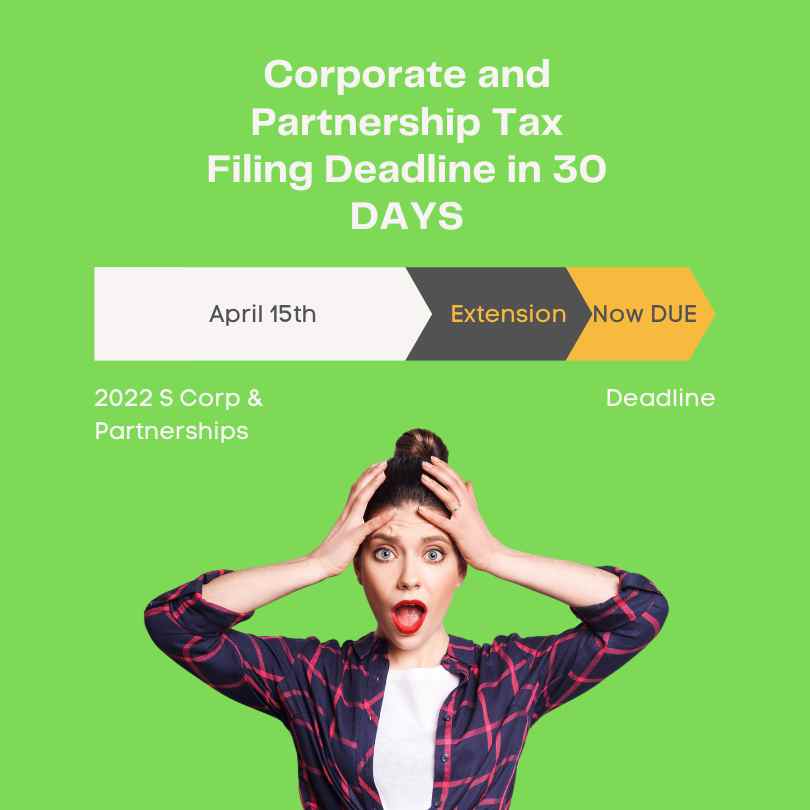

For those of you who filed an extension in March of this year for your S Corporation, multi member LLC or partnership return, the time has come to get that return filed by September 15, 30 days from now.

Have you cleaned up and completed your 2022 bookkeeping? Is your 2022 return in process with your tax preparer? Don’t delay, the closer you get to the deadline, the more overwhelmed and stressed your tax preparer is likely to be. I highly recommend that you meet with your tax preparer now while he or she is just coming off their summer vacation and is fresh eyed and calm.

For these tax return filings, there is little money due. The big dollars will come when you work on your 2022 personal income tax filing next as these S Corp, multi LLC and partnership returns are called “flow throughs” which means that taxable income flows through the entity and lands on your personal income tax return to be taxed there.

Strategy strategy strategy! I cannot stress this enough. Filing tax returns is not just about putting numbers on the page, balancing and ticking. The big picture will affect your life for your years to come so please make sure that you get the advice you need before you file your tax return due on Sept 15th.

We are here to help you every step of the way so don’t be shy to reach out to us and ask ask ask. There are also resources on my website that will be very helpful for your tax filings.