Educating Business Owners about Tax Deductions.

IRS warns of NEW SCAMS

Today the IRS is warning us about a NEW SCAM. This new scam involved your online account are available at the IRS website. Setting up and using your online account helps avoid long and often frustrating phone calls to the IRS. Within your online account you can check...

Marketing Dollars – have you checked your ROI?

I met with three successful fee only financial advisors last week and each one was spending more than 30% of their revenue on Marketing. I was blown away. Their business coaches are pushing them to grow their revenue. I get it. Makes sense but let's look at how we...

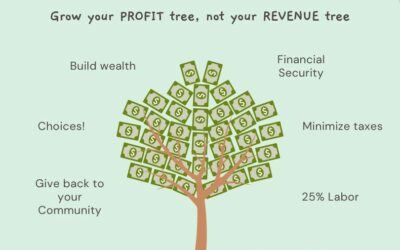

FOCUS on Profit to build our Wealth

Planning your summer vacation? No! Why? Stressed about money, cash flow? Hmnnn, perhaps you have spent your time focused on growing your REVENUE and not your PROFIT. Don't feel badly, I have done this myself as have many successful business owners but the time comes...

Avoid Penalties and Interest – Pay your Taxes ONLINE

With the tax deadline approaching, the IRS reminded taxpayers they can avoid late filing and interest penalties by submitting their tax return and any payments due by April 18. Interest and a late payment penalty will apply to any payments made after April 18. Making...

Frustrated and Confused? Not getting straight answers?

Frustrated and Confused? Not getting straight answers from your accountant? Yes, I hear this a LOT and that is why I am now committed to helping business owners go from frustrated and confused to clarity and confidence. In 25 years as a CPA and running my own firm for...

IRS Reminder – Crypto and Digital Asset Gains are TAXABLE

Today the IRS reminds taxpayers that there's a question at the top of Forms 1040 that asks about digital asset transactions. All taxpayers filing these forms must check the box indicating either "yes" or "no." If an individual disposed of any digital asset that was...

BEFORE you file – have you taken all the tax deductions to which you are entitled?

The corporate income tax return filing deadline is just two weeks ago. BEFORE you sign and file, are you sure that you have taken ALL the business income tax deductions to which you are entitled? This is your money! You have a responsibility to be a good steward of...

Use Online Software to File your Tax Return – Which one should I pick?

Technology has sure come a long way in the twenty five years that I have been filing income tax returns for clients. In the last five years I have been recommending online tax software to my friends, family and colleagues who don't have complicated tax situations and...

How much REVENUE do you need to be SUCCESSFUL?

Most of my clients come to see me with lofty imagined revenue goals. Great! What does that mean? Of the 12% of women business owners who bring in over $100,000 in annual revenue, half (6.2%) make over $250,000 and just 1.9% make $1 million or more. Data from National...

NEW – IRS created the Document Upload Tool

Good news - the IRS has created a Document Upload Tool. So, should you receive a notice from the IRS, don't panic! Open the envelope. Take a breath and take a look. What paperwork are they requesting? Most notices are related to your refund request and or tax credits...